Subsídios para painel solar na Europa: o que precisa saber.

Solar energy has been an innovation with the potential to change the way we generate electricity at scale, with an almost negligible impact on our climate. To promote the adoption of this new technology, numerous countries began offering solar panel subsidies for installations and storage, to encourage utilities, companies and families to adopt this solution at scale and fast. However, despite the best intentions, not all initiatives have been successful.

There is a mix of accurate and inaccurate information about solar panel subsidies on the internet; some information are genuine, other are fake, and some were once valid but have since expired. This blog will give you a brief explanation about solar panel subsidies policies in Europe.

Solar panel subsidies

According to the EU Market Outlook for Solar Power 2023-2027 report, there is significant growth in the solar rooftop segment, indicating that Europe’s citizens and businesses are opting for low-cost solar to control their energy bills. This growth is partly due to government support. We conducted an investigation into solar panel subsidies in Europe to determine which subsidies are still active and worthwhile. Today, we will present and review the situation in European countries to highlight different approaches taken.

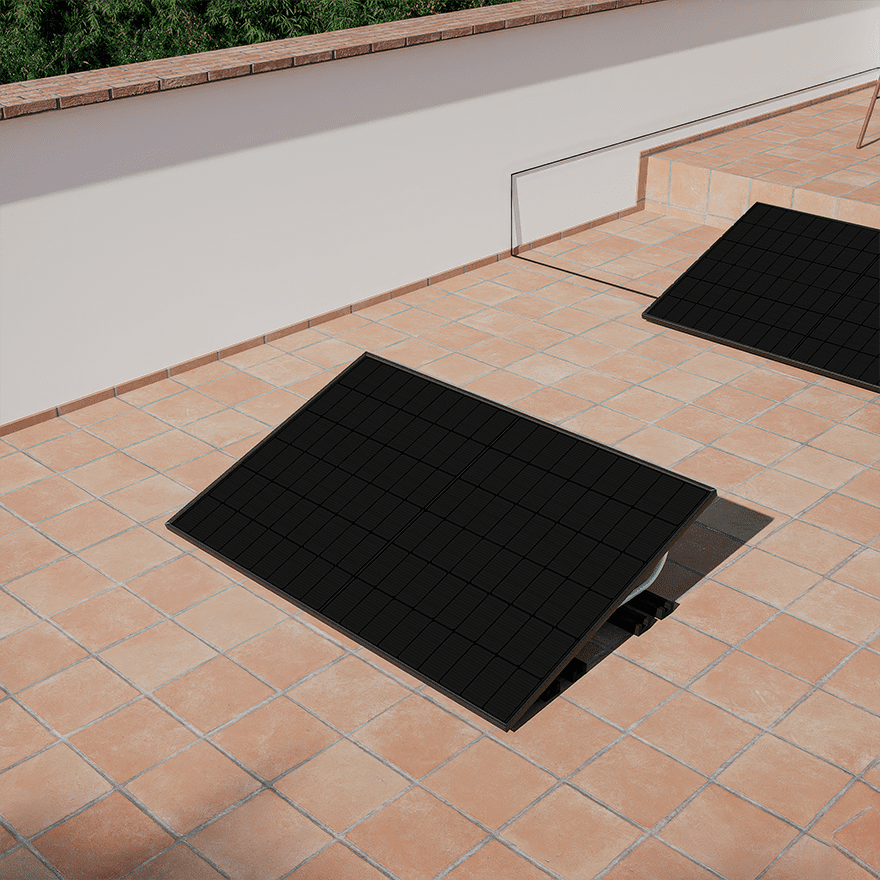

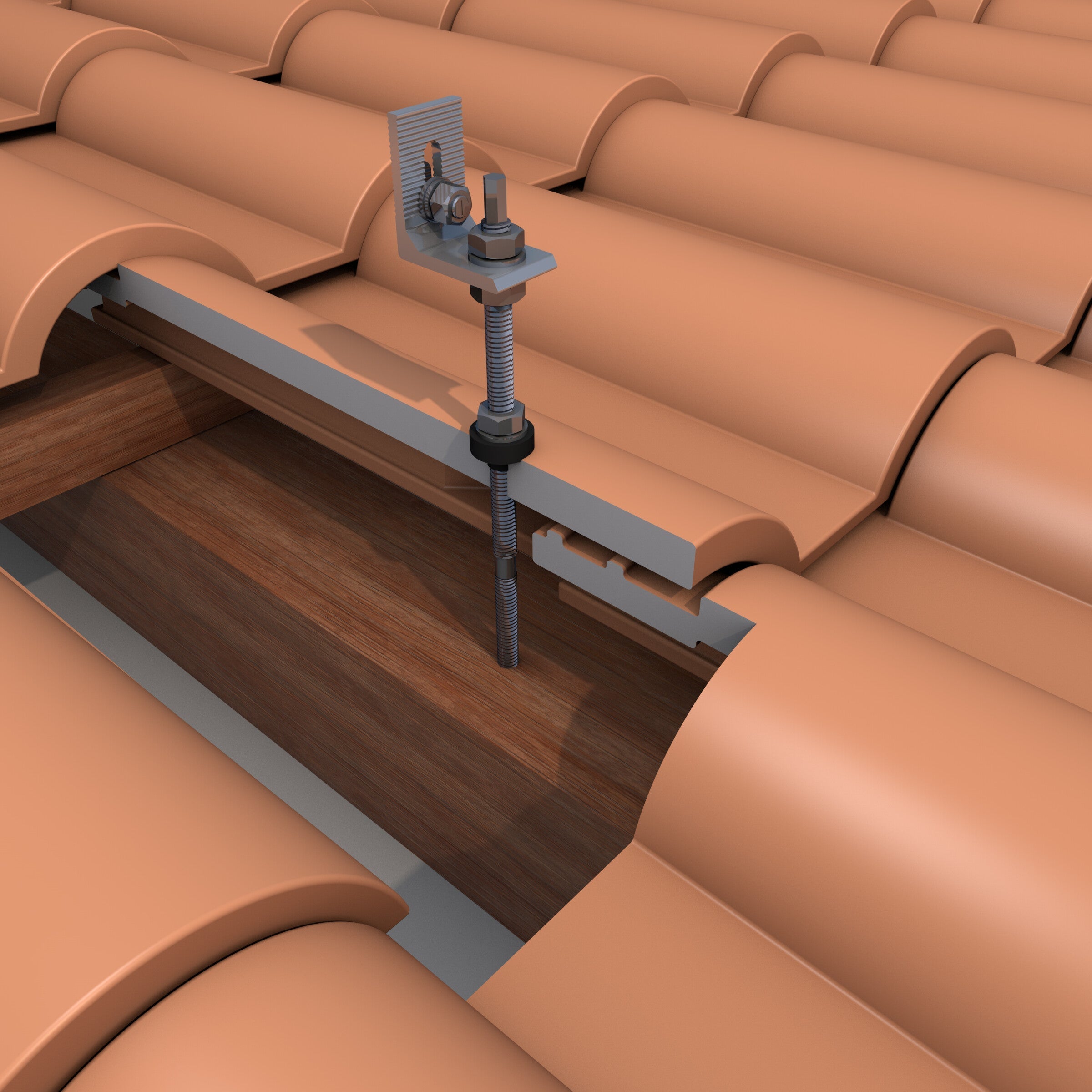

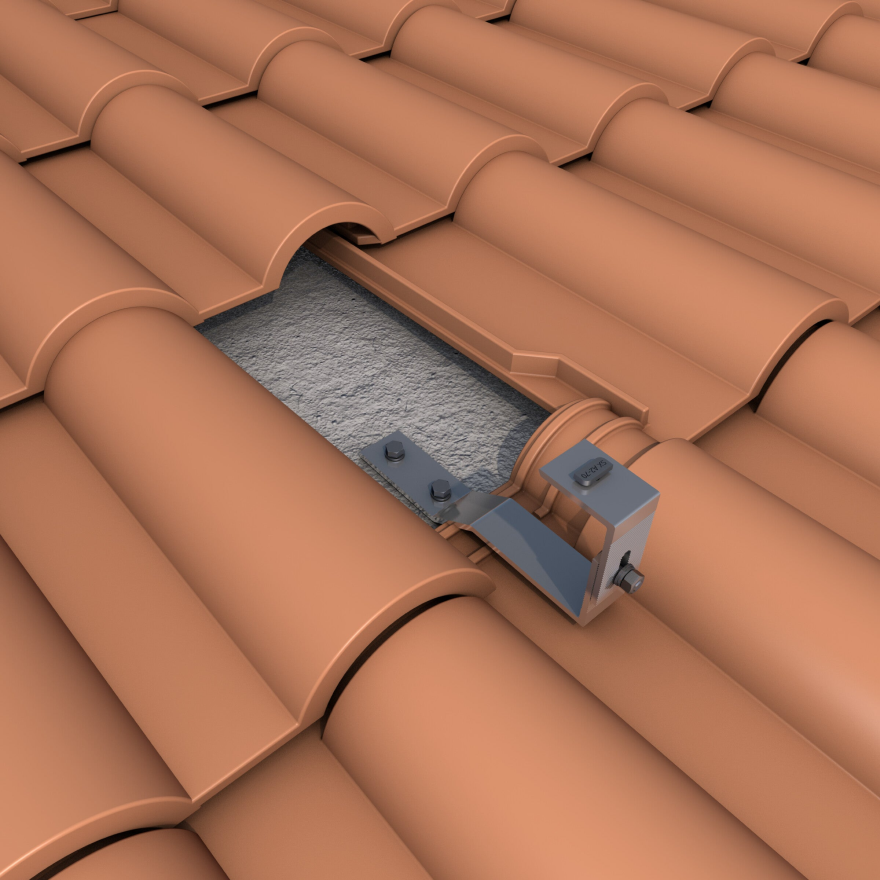

- Germany: As Europe’s biggest solar energy market, any change in Germany affects the rest of Europe. One of the most notable initiatives that the German government has implemented is a zero VAT rate for the supply and installation of solar panels, starting in January 2023. In Germany, the standard VAT is 21% but due to the deduction, customers pay much less of the whole price. This is unlike the solar panel subsidies that come in the future, but an instant cash off at the moment of buying. Another solar panel subsidies are The SolarPLUS program, which offers subsidies for landlords, investors, tenants, owners, and other authorized individuals, providing up to 30,000 EUR for the acquisition and activation of solar energy storage systems, and up to 500 EUR for the costs associated with a plugin solar device. Additionally, it includes attractive grants for roof assessments, metering and measurement plans, and initial tax consultation; find all the information at the German energy agency. Even though we offer very affordable options, this is a benefit that should not be overlooked. We believe this is one of the easiest and most practical ways for a government to encourage consumers to adopt solar panels. The governments simplify the process with solar panel subsidies, and we make installation easy, as demonstrated in the next video which shows a setup in less than 10 minutes.

- Spain: According to the IDAE (Institute for the Diversification and Saving of Energy) there are deductions in income tax (IRPF) for actions to improve energy efficiency, related to the reduction of demand or consumption, both in homes and buildings. Deduction of 20% for home improvement works that reduce energy demand or consumption by at least 7%. Deduction of 40% for home improvement works that reduce non-renewable primary energy consumption by at least 30%. Deduction of 60% for works carried out by homeowners in buildings to reduce non-renewable primary energy consumption by at least 30%. However, to obtain the solar panel subsidies, you must demonstrate a reduction in your energy consumption. This requires a certificate issued by a competent technical person before the installation of any solar energy option to assess your current energy usage. After installation, you need a second certificate to prove the improvement in your energy usage and reduction of it. Only then can you apply for the solar panel subsidies. In summary, you must invest in the solar panel installation and obtain two certificates to qualify for a discount, making three payments in total to receive the IRPF tax deduction. Get fully informed in the Guide on tax reductions. On the other hand, you can purchase an affordable plugin solar kit and start saving money immediately, without the need for triple paid, extensive paperwork, or long waiting periods. When comparing both options, it is much faster and more practical to choose our various Robinsun options and get real savings from day one. You also can start calculating how much you can reduce from your energy bill with our Savings Calculator. Until the end of 2023, the Spanish government also offered solar panel subsidies, but the process was tedious. It involved lengthy waiting periods and extensive paperwork, saturating the processing capacities of many public institutions. Also, solar panel subsidies paid were subject to taxation, reducing the net amount received by families. ¿Do I need to declare the grants and subsidies I have received to the tax authorities?.

- Portugal: Portugal aims to incorporate 47% of energy from renewable sources into the gross final energy consumption according to Plano Nacional de Energia e Clima (PNEC) Portugal has decided to reduce VAT as solar panel subsidies. If you are reading this from Portugal and you want to buy our plug & play solar kit today, you will notice that the kits just got cheaper and only 6% of theVAT has been applied (The standard VAT rate is 23%).

- Netherlands: The Netherlands government is encouraging people to increase their self-consumption with solar panel subsidies such as reducing the VAT to 0% on photovoltaic systems installed in family homes. Also, You consume a portion of the electricity generated by your solar panels, while the surplus is fed back into the electricity grid. If the amount you feed back exceeds your consumption, your energy supplier will compensate you. This process is known as the netting arrangement (salderingsregeling). You can see how to apply for a subsidy in the Netherlands Tax Administration.

Conclusions

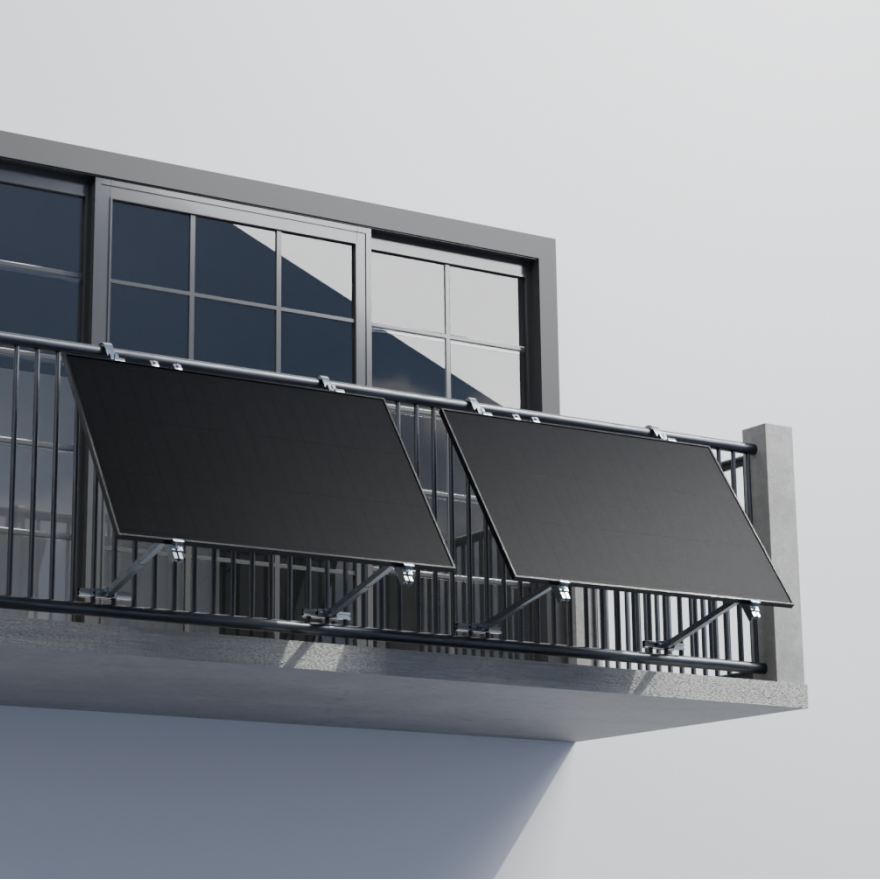

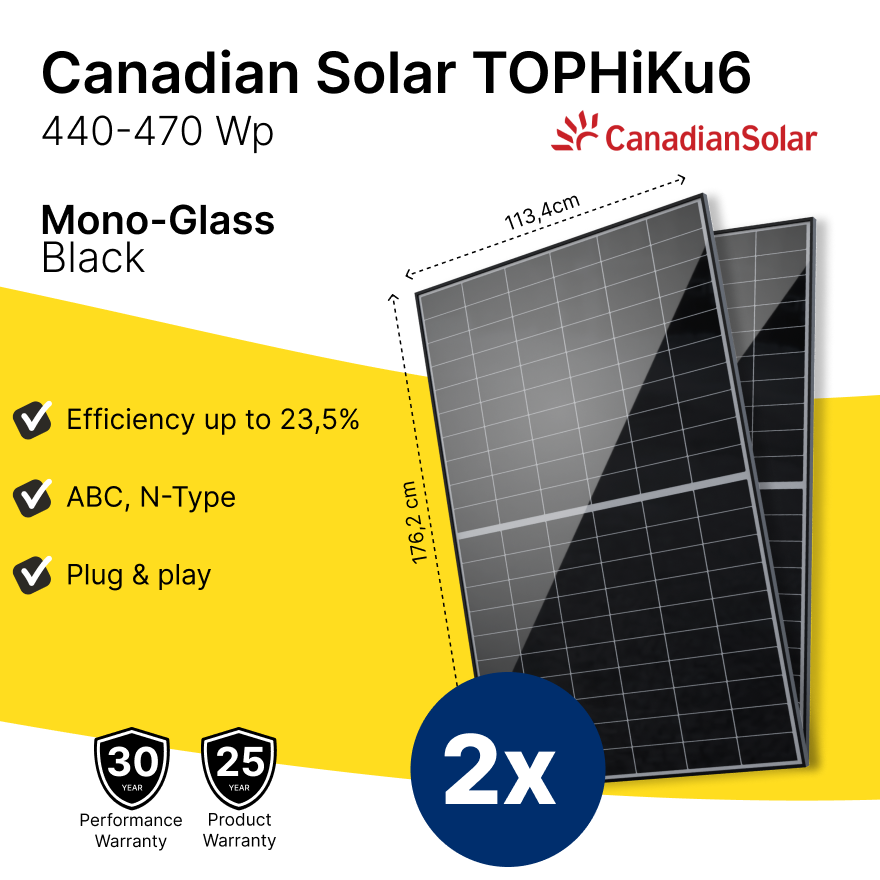

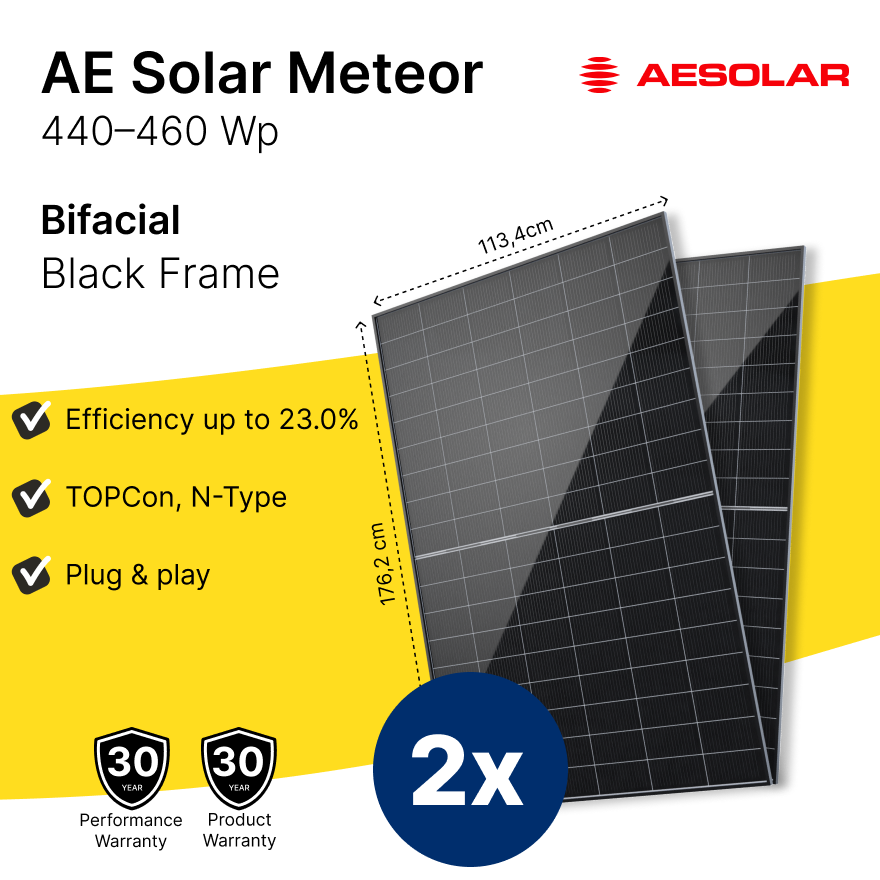

In conclusion, there are different solar panel subsidies in European countries, aimed at encouraging families to install solar energy for self consumption. Thanks to our new products, we can offer different options at very affordable prices with super easy installation. You no longer need to wait, make paperworks or even pay extra to get solar panel subsidies that don't even cover much of the total price. We invite you to explore our options and learn how quickly, affordable and easily you can start producing your own energy, saving on your bills, and helping the planet. Feel free to contact us through email, WhatsApp, call us directly if you have any questions.

2 comentários

Hola quiero paneles solares para techo y paneles solares colgados para balcones. Que ayudas tengo del gobierno. Gracias

Marc

Solar panel subsidies in Europe are a great way to promote renewable energy adoption. Countries like Germany, Spain, Portugal, and the Netherlands are offering innovative incentives like reduced VAT and tax deductions. These policies encourage individuals to reduce energy consumption and contribute to a sustainable future while saving on electricity bills.

Painéis solares portugal

Deixe um comentário

Este site está protegido pela Política de privacidade da hCaptcha e da hCaptcha e aplicam-se os Termos de serviço das mesmas.